So you have a great business idea? You are trying to make it solo? What are some of the steps you can take to get going on that idea? There are many things to consider from business registration, product/service launch, marketing, accounting, taxes etc.

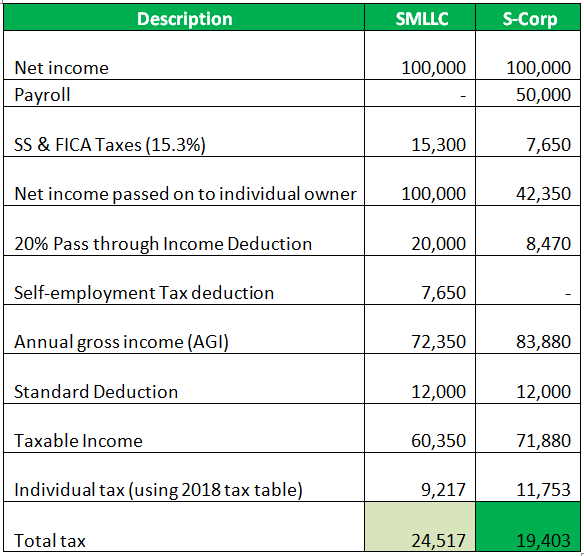

I have prepared a simple calculation (shown in a table below) to highlight potential tax savings offered by one entity structure over the other. Scroll down if you are one of those accountants who want to get down to numbers … OR.. read few lines prior to getting there. Your call!

So let us go back to the situation where you are embarking on a business venture. Let’s start with the business registration. Identifying an optimum business structure for your company is a key. There are many options to choose from. For example, sole proprietor, Single Member Limited Liability Company (SMLLC), S-Corp, C-Corp and list goes on. I will evaluate few of these below:

Sole Proprietorship:

I would only recommend this to someone who is starting a side gig with very little probability of liability. A good example is someone who for example delivers packages using personal car and generates a small amount of money. From tax perspective, the person may want to go without registering the business and report delivery income on schedule C of the personal tax return form (1140). However, if there is a slight chance of exposing yourself to a liability, then consider limiting your liability by registering a company. So let’s looks into that:

Limited Liability Company:

As indicative form the name, this type of business will limit your personal liability. From tax side you can choose to have:

1. Single member LLC (SMLLC)

a. No separate tax return for the LLC needed

b. Concept is very similar to sole proprietor but the liability is limited

c. Income and expense will flow on schedule C of 1040

d. Net income will be subject to self-employment taxes

2. Election to be treated as Small Corporation (S-Corp)

a. Separate tax return for the LLC is required (1120S – Form)

b. Liability is limited

c. IRS requires members to withdraw a reasonable salary

d. Net income flows to 1140 and is not subject to self-employment taxes

3. Election to be treated as C-Corp

a. Separate tax return for the LLC is required (1120 – Form)

b. Liability is limited

c. A combination of salary and dividends can be taken. Since dividend is subject to favorable tax rate, IRS has successfully challenged many cases and has re-classed dividends to salary

d. Dividends and salaries flow to 1140

e. No self-employment taxes

Which structure is favorable for you from tax perspective?

The answer is “IT DEPENDS”. It depends on level of your income. Let me show this in a simple example to compare tax impact of choosing a simple LLC structure vs an S-Corp. The following assumptions are used:

· Net income is $100,000

· Filing status is single

· Tax year is 2018

· Only standard deduction is being used

· No above the line deduction

Now we can add C-Corp treatment in the mix but it might be a little too complex to explain here. However, we are always here to answer your queries. So feel free to reach out!

Conclusion: The above example shows how S-Corp is a preferred way to organize your business from tax perspective. Don’t forget to factor in admin cost for S-Corp. Consult our Certified Public Accountant (CPA) or Tax Accountant to assess your specific scenario prior to making a decision.

Note: The above illustration is a very simplistic version of events with many assumptions. It is only meant for a guide and is not an advice. The company, this website, or the writer takes no responsibility for any liability. Your particular tax situation will derive the specific tax strategy. Please consult us for your specific scenarios and we will be happy to talk you through your taxes and accounting matters.