The new tax law is going into effect in 2018. Many are wondering what real impact it brings on their household income. Corporations are undoubtedly the biggest winners under the new tax law. Individuals are wondering what they can possibly do to reduce their tax burden. I am going to summarize few areas that can help you.

Retirement Accounts:

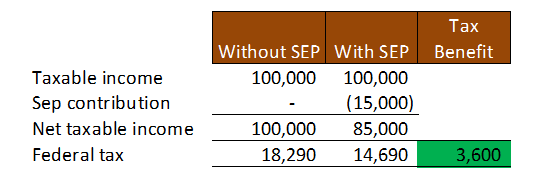

Although not a new concept, contributing to IRA can bring some serious savings. For example individuals with small businesses and/or self-employment income, can contribute to IRAs such as SEP. Numerically speaking if your filing status is single for 2018 and your self-employment income is approx. $100k. This puts you in 24% marginal tax bracket. You have the opportunity to set aside certain amount in SEP IRA. Let’s assume you decide $15k. See below for the difference in tax liability:

In the above example, you have a saving of $3,600 by putting aside $15k from your taxable income into SEP.

Bundle your Donations:

If one year’s worth of donations cannot put you beyond standard deduction limits, consider donating next year’s in the current tax year. Under new tax law the standard deduction limits have been raised to $12k and $24k for Single and Joint tax statuses, respectively. To itemize your deductions, you will have to go beyond the standard deductions above.

Bigger Family Helps:

New tax law gives you $2k per qualified child in tax credit. If 2 children you get $4k, if 3…..you get the math!

Now I am not suggesting to act one way or the other on your family situation just to get tax credit.

Incorporate Business:

Businesses under new tax law are eligible to deduct 20% of net income under newly introduced Qualified Business Income (QBI) deduction.

Beside what is mentioned above, there is much more you can do to legally save taxes. The key is to plan and strategize. Consult your CPA before making any important financial decisions. The benefits may significantly outweigh the cost.

Disclaimer: The above write-up is not an advice. Your particular tax situation will derive the specific tax strategy. Please consult us for your specific scenarios and we will be happy to talk you through your taxes and accounting matters.