Blog Posts

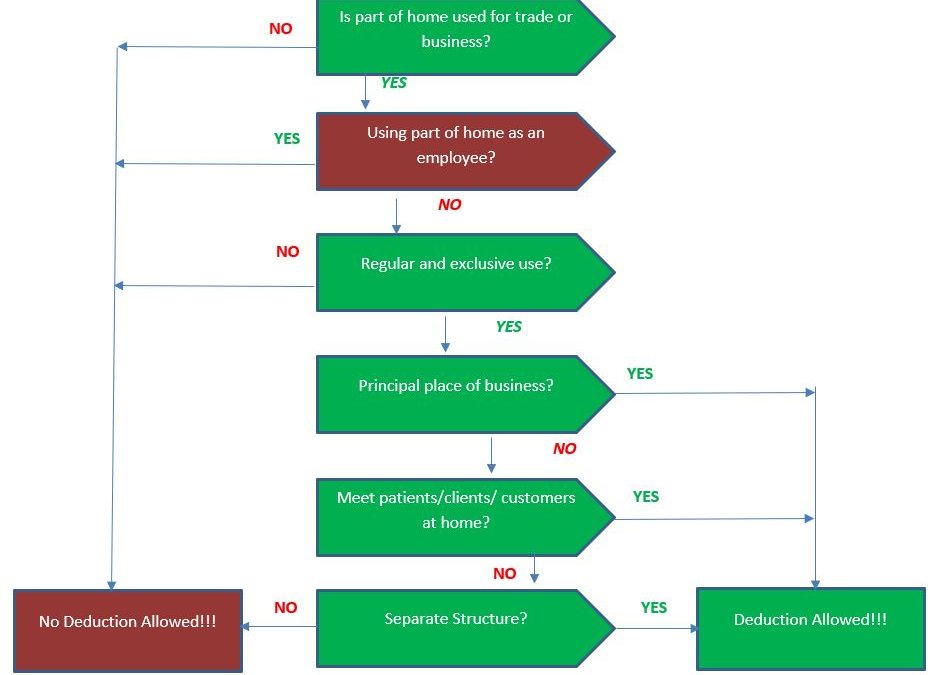

Using home as your new office? Check if you can take tax deduction for home office…

Under IRS publication 587, you can deduct items related to your residence as a legitimate tax expense. These items include mortgage interest, real estate taxes, utilities, maintenance, rent, depreciation, or property insurance. However, to qualify as a deductible...

Subscribe

Tax Season and Tax Scams

As the tax deadline approaches, scammers are working on new ways to steal consumer information....

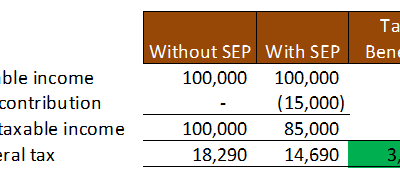

Want to Save Taxes? Read this…

The new tax law is going into effect in 2018. Many are wondering what real impact it brings on...

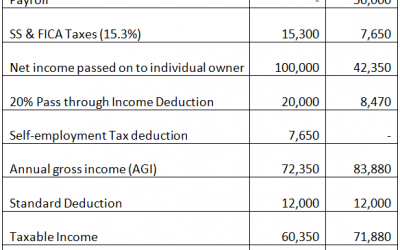

What is the Appropriate Tax Structure for Your Small Business?

So you have a great business idea? You are trying to make it solo? What are some of the steps you...