by admin | May 28, 2020 | Uncategorized

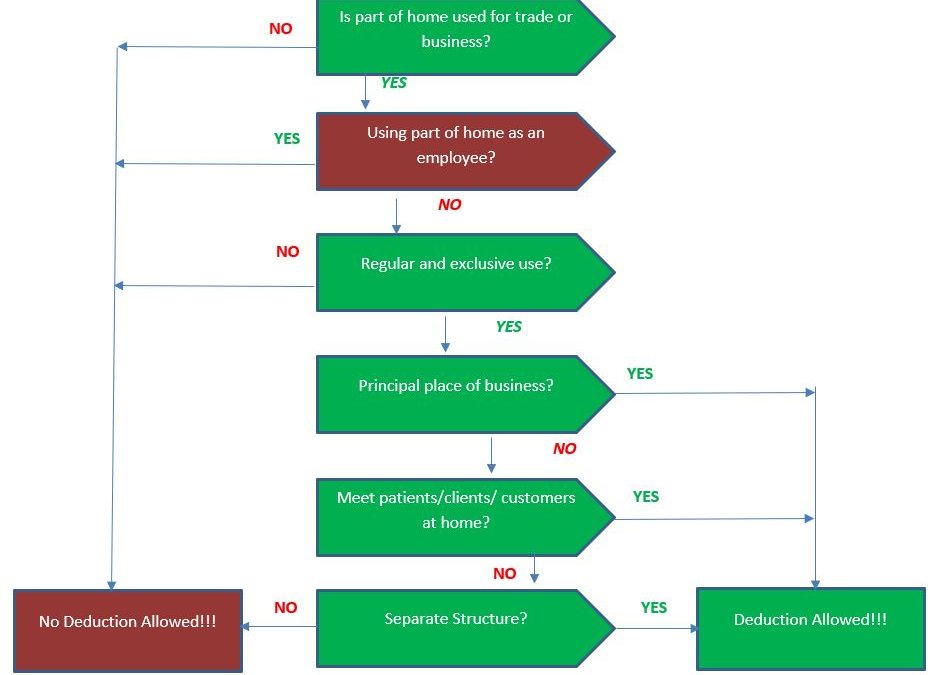

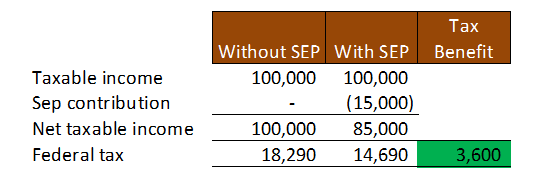

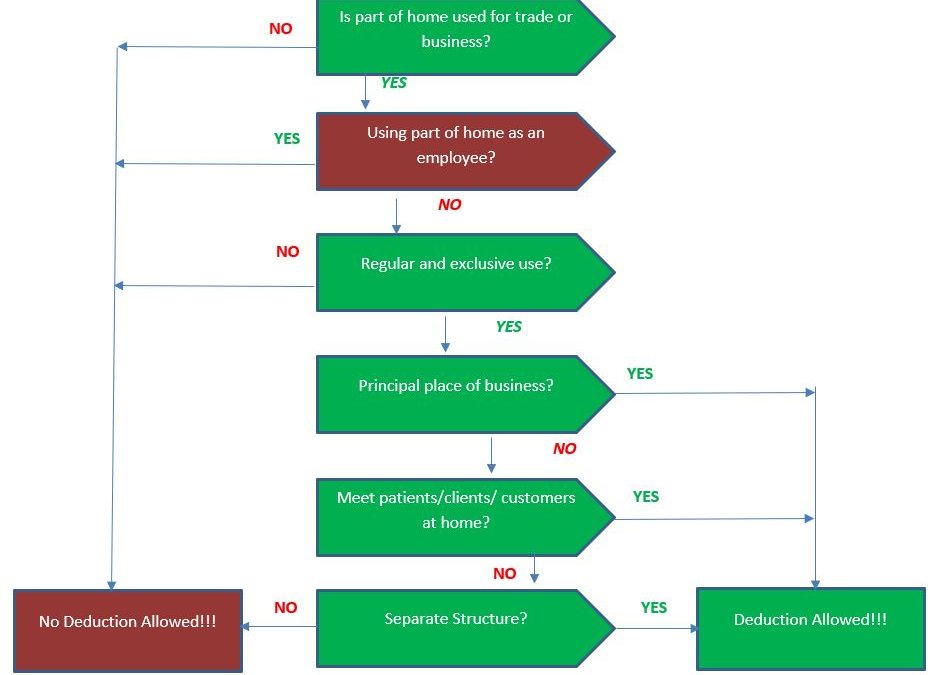

Under IRS publication 587, you can deduct items related to your residence as a legitimate tax expense. These items include mortgage interest, real estate taxes, utilities, maintenance, rent, depreciation, or property insurance. However, to qualify as a deductible...

by admin | Aug 7, 2018 | Uncategorized

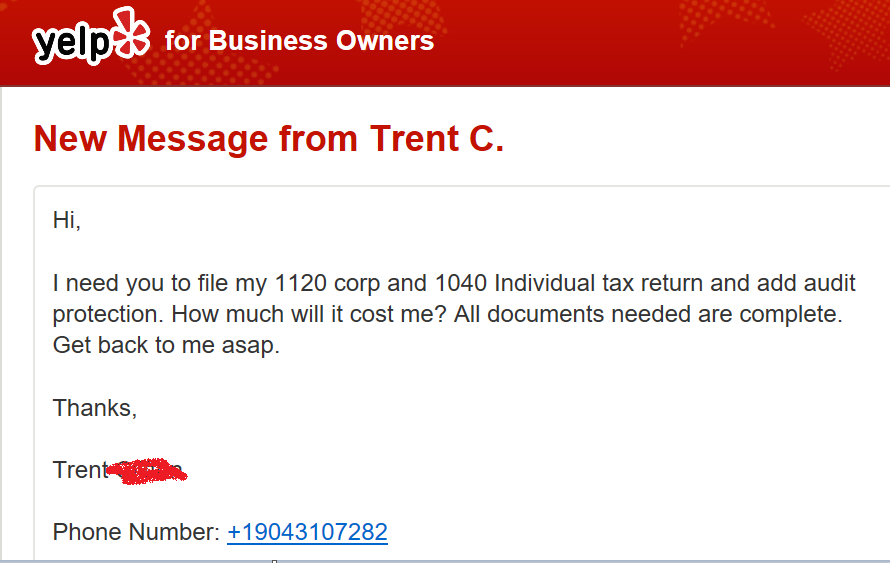

As the tax deadline approaches, scammers are working on new ways to steal consumer information. Primary targets are small CPA firms that advertise on platforms such as Yelp, Craigslist etc. I recently came close to becoming a victim of the data theft. I used caution...

by admin | Jul 2, 2018 | Uncategorized

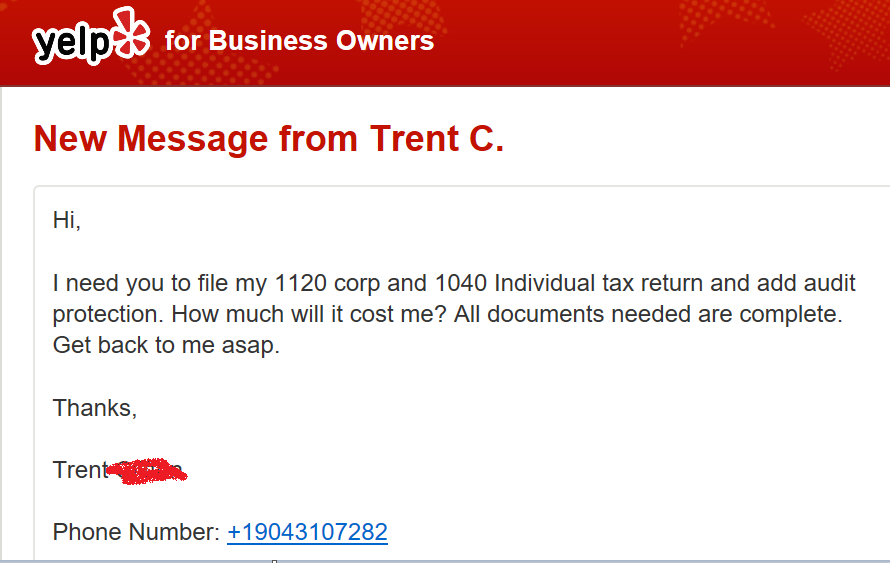

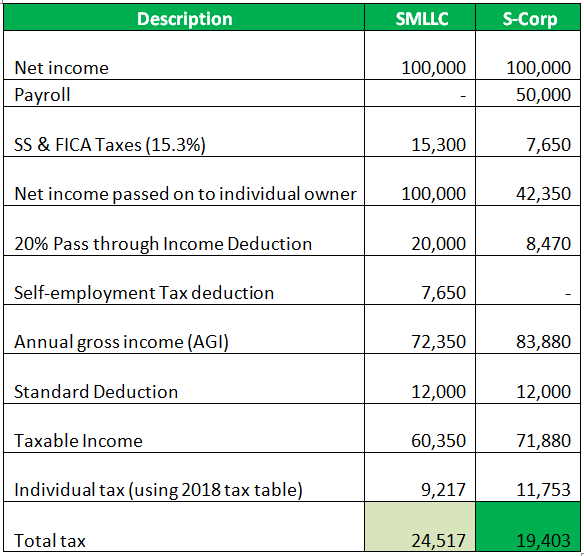

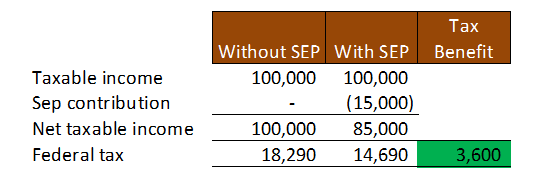

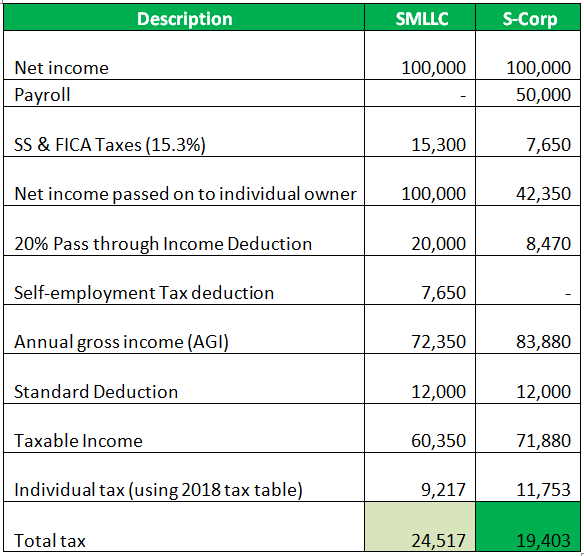

The new tax law is going into effect in 2018. Many are wondering what real impact it brings on their household income. Corporations are undoubtedly the biggest winners under the new tax law. Individuals are wondering what they can possibly do to reduce their tax...

by admin | Jun 18, 2018 | Uncategorized

So you have a great business idea? You are trying to make it solo? What are some of the steps you can take to get going on that idea? There are many things to consider from business registration, product/service launch, marketing, accounting, taxes etc. I have...